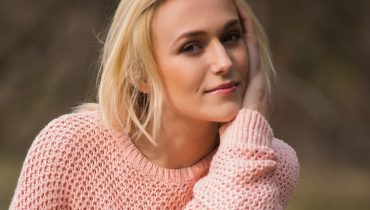

Every month you pay for health insurance; however, are you really optimizing its value? Felicity Parker offers smart techniques to make sure you’re not passing on money or services. Here’s how to maximize your plan from scheduling your care to secret benefits:

Know Your Benefits Inside Out: Felicity’s golden rule: yearly check your plan documentation. Many individuals ignore advantages like free yearly physicals, mental health sessions, or wellness programs—e.g., dietary counseling or smoking cessation. Usually fully covered, these save hundreds.

Preventive Care Is Your Best Friend: Not only are routine tests and immunizations important for your health; most policies allow them to be free. Felicity advises using them to identify problems early on so as to save later expensive procedures.

Timing Matters: Plan elective surgeries before the deductible is reset if you meet it late in the year. On the other hand, defer non-urgent treatment until the next calendar year if you are far from meeting it to prevent twice paying out-of-pocket costs.

Appeal Denied Claims: Sometimes insurance companies wrongly refuse claims. Felicity counsels always reading Explanation of Benefits (EOB) documents and, if needed, appealing. Often the judgment can be reversed with a polite call or letter together with supporting evidence.

Use In-Network Providers Strategically: require an MRI? Felicity advises contacting your insurance company for the least expensive in-network institution; rates vary greatly. Some plans also provide online cost-comparision tools.

Leverage Discount Programs: For discounts on gym memberships, supplements, or even hearing aids, several insurance companies team with stores. Search the website of your insurance for these sometimes disregarded benefits.

Coordinate with an HSA/FSA: Use the tax-advantaged funds in your Health Savings Account (HSA) or Flexible Spending Account (FSA) to cover qualified costs, therefore stretching your money even further.

Health insurance is a tool, not only a safety blanket, Felicity says. Being proactive and aware can help you turn your monthly expenditure into a great benefit for your pocketbook and well-being.